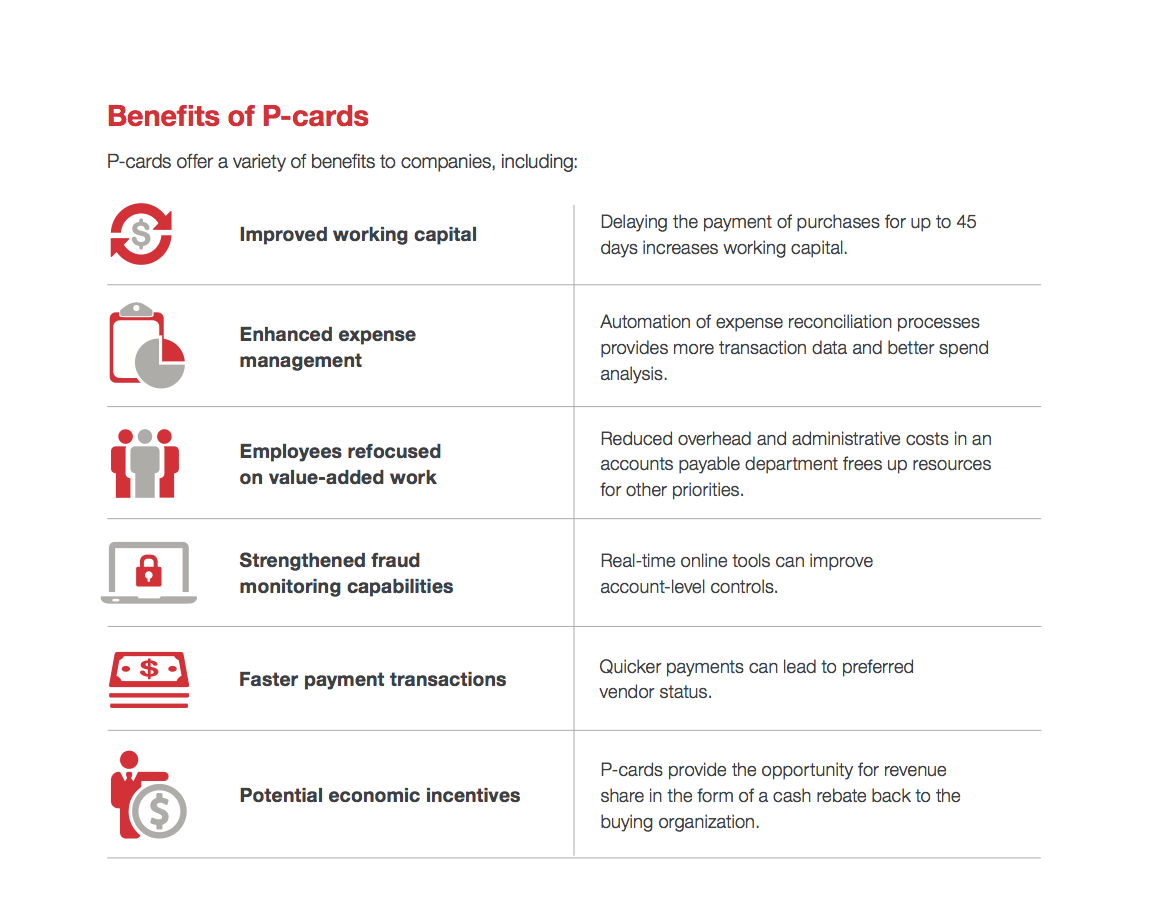

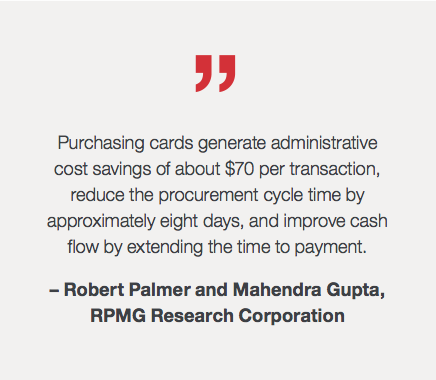

Purchase cards—also known as P-cards or procurement cards—provide businesses with significant opportunities to streamline processing and improve working capital. By replacing paper invoices and manual systems, P-cards help businesses cut operating costs, automate expense reconciliation processes and provide valuable insights on spend patterns. In addition, risk controls are enhanced and quicker payments improve supplier relations and help businesses earn valuable rebates and discounts.

Replacing Paper with Electronic Payments

While great strides have been made in migrating from paper to electronic payments, traditional paper checks continue to be the leading payment vehicle for B2B transactions. Two out of every three payments by middle market companies are still made by check, while nearly half of large corporation payments are paper-based. In addition, many organizations still use inefficient paper-based invoice and payments processing systems that are not only error-prone and time-consuming, but susceptible to fraud.

While great strides have been made in migrating from paper to electronic payments, traditional paper checks continue to be the leading payment vehicle for B2B transactions. Two out of every three payments by middle market companies are still made by check, while nearly half of large corporation payments are paper-based. In addition, many organizations still use inefficient paper-based invoice and payments processing systems that are not only error-prone and time-consuming, but susceptible to fraud.

It comes as no surprise, then, that organizations are seeking ways to replace paper-based payments with electronic transactions. This is amply reflected in the results of the 2015 AFP Payments Cost Benchmarking Survey, which reported that 79% of all organizations are looking for ways to convert paper checks to electronic payments.

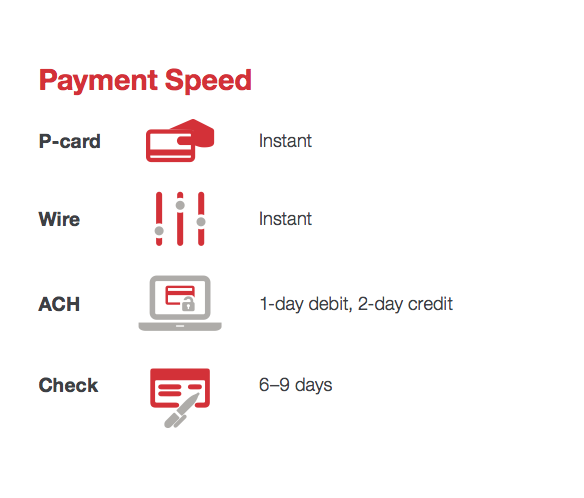

P-cards can play an important role in the transition to automating  payments to suppliers. A form of company charge card, P-cards replace checks when a company buys goods and services. Used instead of a purchase order, check request or petty cash, purchase cards can be used for both high-dollar and low-dollar transactions with any vendor that accepts credit cards. With the potential to sharply reduce the use of purchase orders and invoices and the volume of checks processed, P-cards can make a significant contribution to an organization’s payment efficiency.

payments to suppliers. A form of company charge card, P-cards replace checks when a company buys goods and services. Used instead of a purchase order, check request or petty cash, purchase cards can be used for both high-dollar and low-dollar transactions with any vendor that accepts credit cards. With the potential to sharply reduce the use of purchase orders and invoices and the volume of checks processed, P-cards can make a significant contribution to an organization’s payment efficiency.

A KeyBank Middle Market Business Sentiment Survey released in July 2015 revealed that more than a quarter of businesses may not understand the potential opportunities and benefits available to them with purchasing cards. As a result, many organizations are not taking advantage of the enhanced efficiency that P-cards provide.

Implementing a Successful P-card Program

Companies considering implementation or expansion of a P-card program can benefit by incorporating best practices of industry leaders in purchase card usage.

Companies considering implementation or expansion of a P-card program can benefit by incorporating best practices of industry leaders in purchase card usage.

One of the most important determinants of success is the selection of a seasoned financial payments partner. A bank that has specialized expertise and a commitment to payments technology can play an invaluable role in helping companies from strategy through implementation. In addition, a strong bank partner will continue to work with an organization to optimize P-card utilization on an ongoing basis after the program launch.

Other best practices include:

- Gaining corporate buy-in and executive sponsorship to ensure the project is given a high priority.

- Forming a cross-functional team that is dedicated to the P-card project.

- Completing a thorough vendor-match analysis to gain insight into the overall card opportunity and determine where to target P-card spend. Your bank partner can often provide meaningful assistance with this.

- Building a business case that includes a review and documentation of the current procurement process and costs, determination of the costs of paper management vs. purchasing card utilization, deciding on the mix of P-card types to use, and quantification of the expected return on investment, including potential rebate opportunities.

- Establishing benchmarks against which the program can be measured and forming or modifying expense policies, procedures, and the audit and compliance framework.

- Spreading P-card adoption in all lines of business.

- Developing and implementing a communications and training strategy to keep card users and program participants informed and on board.

Successful programs also track performance diligently to demonstrate the value of P-cards and identify opportunities for expansion.

Making P-cards a Reality at Your Company

An important and widely accepted part of today’s electronic payments environment, P-cards help companies optimize cash flow, streamline processing, reduce expenses and safeguard your company from fraud. In addition, P-card programs can enable your company to track expenses, take advantage of supplier discounts and revenue in the form of rebates, and reduce or redirect staff in the accounts payable department.