Schwabe, Williamson & Wyatt, P.C., and Aldrich CPAs + Advisors released the State of Manufacturing in the Pacific Northwest, a survey detailing insights from more than 500 industry leaders across the region. The study found that a majority of manufacturing leaders have a positive 12-month outlook for their own companies and the industry despite pandemic and other ongoing challenges. The most pressing challenges and opportunities for innovation leaders identified include growing their workforce, expansion plans, impacts from regulations, and investments in new technology.

“Despite ongoing challenges, we are excited to learn that most manufacturers see an abundance of opportunity in 2022,” said Michael Cohen, Manufacturing, Distribution and Retail Industry Group Leader at Schwabe, Williamson & Wyatt. “

With a majority of companies identifying opportunities for growth in multiple avenues, the year ahead is promising for the manufacturing community.”

This is the second edition of the State of Manufacturing in the Pacific Northwest survey, with the first edition published in 2018. The report shines a light on the topics that matter most to the industry and provides insight into the changes that have affected the manufacturing sector. “Though ripple effects from the pandemic continue, it’s clear that manufacturing leaders see growth opportunities in the year ahead,” said Carrie Sowders, Partner at Aldrich CPAs + Advisors. “The resiliency and innovative thinking of Pacific Northwest manufacturers can be heard throughout the study.”

Big Picture Business Forecast

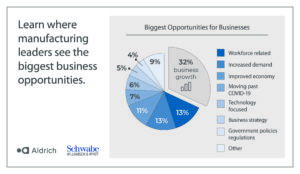

When asked about their biggest opportunity, survey respondents pointed to the potential for business growth. In fact, six of ten manufacturers in the Pacific Northwest are currently exploring expansion plans, including growing the size and breadth of facilities and office locations, their workforce and geographic location.

When asked about their biggest opportunity, survey respondents pointed to the potential for business growth. In fact, six of ten manufacturers in the Pacific Northwest are currently exploring expansion plans, including growing the size and breadth of facilities and office locations, their workforce and geographic location.

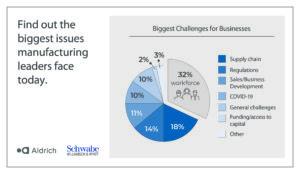

The top three challenges businesses face right now are related to workforce, supply chain and regulations. When asked to identify the top challenges hindering business, eight out of ten leaders are concerned about the escalating costs of doing business. Other concerns shared include the cost of materials and shipping, employee benefits and putting new COVID-19 protocols in place.

More than three-quarters of those surveyed are also concerned about supply chain disruptions. Manufacturers have experienced supply chain issues over the last year due to the pandemic, such as rising freight costs, scarcity of materials or trade issues.

Overall, there was a decline in confidence from the 2018 State of Manufacturing in the Pacific Northwest survey, which may indicate ongoing concerns related to taxes, regulations and tariffs.

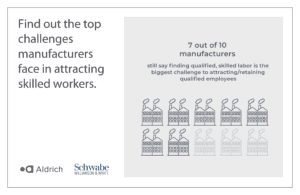

Workforce Challenges and Promoting Equity and Diversity

The top challenge manufacturers face continues to be attracting and retaining a skilled workforce. While a shortage of skilled labor is the top challenge for Oregon manufacturers, more Washington manufacturers cited competition from other employers and maintaining competitive compensation or benefits as bigger challenges

“We as industry leaders need to set the example for providing a living wage, and parental and family leave support. This is how we can achieve our diversity goals and attract the best talent,” said a manager at an Oregon manufacturer.

When asked, manufacturers said the top three ways they promote diversity and equity in their workplace include efforts around pay equity, providing a safe platform for employees to express their voice, and eliminating bias from employee applications.

Regulatory Roadblocks

The industry regulations identified as having the biggest effect on manufacturers’ bottom lines center on wages and benefits, taxes, and land and real estate. Eight out of ten manufacturing leaders are concerned that state laws and regulations place additional costs and taxes on employers. In addition, half of respondents say current regulations and policies have caused the price of their supplies to increase, which has forced businesses to increase the selling cost of their products.

Oregon manufacturers noted regulations around working conditions as the second biggest regulatory concern. In contrast, Washington manufacturers are more concerned about regulations around export/import and health and safety than those in Oregon.

Oregon manufacturers noted regulations around working conditions as the second biggest regulatory concern. In contrast, Washington manufacturers are more concerned about regulations around export/import and health and safety than those in Oregon.

Nearly half of those surveyed perceive their current state and local business tax policies as anti-business, a sentiment more commonly shared by Washington manufacturers (50%) than those in Oregon (36%). In addition, the smaller the manufacturer, the more likely they are to view business tax policies as anti-business

The perspective on tax policies has shifted noticeably since the 2018 survey, when about two-thirds of Oregon manufacturers and one-third of Washington manufacturers felt that policies were anti-business.

Technology Moving Industry Forward

While manufacturers currently use various technologies to remain competitive, eight out of ten plan to increase their technology investments over the next 12 months. This includes purchasing new computer software, hardware and equipment, and cloud and automation technology.

“Increasing digital transformation enables more access to customers globally,” said a senior vice president at a high-tech company in Washington.

Across the board, manufacturers view data privacy and cybersecurity threats as the most important technology focus areas. They also placed a high emphasis on integrating new technology, keeping up with new/emerging technologies, and watching the age and usability of their internal systems.

Methodology

The study was conducted online by the American City Business Journals and consisted of 543 participants from various manufacturing sectors. The purpose of the survey was to assess manufacturing leaders’ perceptions of the industry broadly and inform future communications and services related to manufacturing in the Pacific Northwest.

The full survey findings can now be downloaded at schwabe.com/state-of-manufacturing.

About Schwabe, Williamson & Wyatt

Schwabe, Williamson & Wyatt is a Pacific Northwest law firm that offers a new type of client experience based ?on a ?deep industry focus. We provide a wide range of legal services to our clients through ???comprehensive, ?proactive, and industry-focused advice to help them achieve their goals. We ??focus on six industry sectors: Healthcare and Life Sciences; Technology; Transportation, Ports, and Maritime; Real ??Estate and ?Construction; Natural Resources; and Manufacturing, Distribution, and Retail. With ?nearly 170 attorneys, Schwabe is one of the largest Pacific Northwest ?regional law firms, ?with ?offices in Portland, Bend, and Salem, Oregon; Seattle and Vancouver, Washington; Mountain View, California; and Anchorage, Alaska.