This is a Guest Blog post by Moss Adams,OMEP sponsor. Originally Published Here Your business could see a significant impact on margins when you optimize your e-commerce operations and identify opportunities for improvement during each step of the supply chain. There are three main considerations for business owners expanding overseas and trying to achieve a true global supply chain:

- Sourcing and shipping. How product origin and your logistics choices impact taxes and duty.

- Product pricing. How taxes, duties, fees, and regulations on international shipments impact product pricing.

- IT systems. How technology can help support tax and trade compliance on worldwide sales as well as shipment tracking.

Sourcing and Shipping

One of the primary goals for an e-commerce business is to deliver products to the customer at the best possible price. Looking at the supply chain from end to end and analyzing all available options could help reduce costs and provide the customer with a seamless and transparent shopping experience, as well as competitive prices.

4 Sourcing and Shipping Decisions

When looking at your product supply chain, there are four fundamental decisions your business needs to make. The answers to these questions typically need to be made on day one when the framework of the supply chain is being built. Implementing the right framework could protect your business from compliance, legal, and tax implications.

- Who will be the importer of record? Importer of record is the entity responsible for getting goods across a foreign border.

- Will you invest in the compliance, legal, regulatory, and tax requirements to either sell to or operate in any jurisdiction? There’s generally a minimum cost of entry to managing a true global, direct-to-consumer (DTC) e-commerce supply chain.

- Which business partners bring the best support to your global supply chain? Business partners could be your 3PL, FedEx, DHL, UPS, agents, or customs brokers.

- Where will you source products from? Identical products sourced from different countries of manufacture can impact the cost of the final product because of customs and duty expense. There are also taxes due on sales, logistic and transportation costs, and third-party logistics (3PL) fees to consider. Not understanding these costs could result in lost revenue, and an inconsistent customer experience because of pricing, shipment times, and ease of product returns.

Ultimately, your global supply chain should deliver a seamless customer experience, offer consistent multichannel pricing, and meet targeted profit levels. Going through the process of answering these questions can help you get there by identifying your business’s weaknesses, areas of opportunity, and where you can fine tune your supply chain.

Challenges with Online Stores and Global Sales

Global e-commerce businesses selling through their own online store or through a reseller must navigate several challenges.

Challenges

- Increased demand leads to lengthy sourcing and shipping delays, especially for goods shipped via sea to the United States.

- Raw material shortages force businesses to explore alternative manufacturing locations.

- Increased costs impact margins or can result in less competitive pricing.

- New markets bring differing customer demands or expectations.

Product Pricing

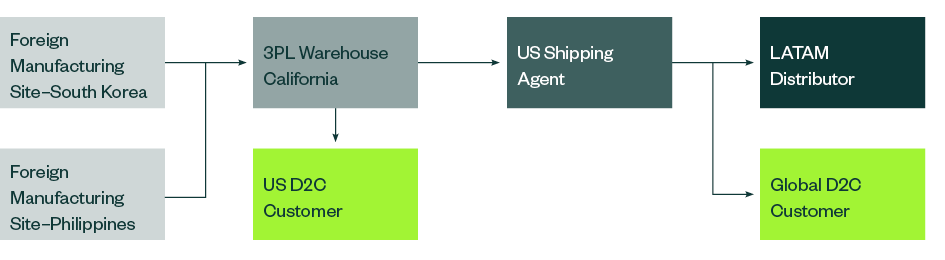

It’s important to analyze each stage of the supply chain to determine the most cost-effective route from manufacturer to customer; some factors could impact the final price of the product. Analyze key taxes, duties, and fees, as well as the items listed below to determine where cost savings and optimizations are possible for your e-commerce business. Creating a flow chart can aid in setting up an efficient supply chain. This shows where products originate from and the various steps and partnerships necessary to deliver product to the customer. Flow Chart Example

Originating Country

There are thousands of potential supply chain routes. What’s best for your business depends on what your product is, where it originates from, and which countries and 3PLs are involved in the supply chain from start to finish. For example, due to existing tariffs on various products, a product that originated from China versus one from Japan can have a considerable impact on the amount of duty you would pay in the United States.

Factors to Consider

There are several factors business owners could consider when setting up a supply chain and determining product pricing:

- Certificate of origin

- Use of free-trade agreements

- Duty drawback

- Export control

- Use of bonded facilities

- Importer of record

- Import regulations

- Wayfair and economic-type nexus in the United States

- Marketplace—Amazon versus an online store

- Value-added tax, or VAT

The last three factors are of particular note because they generate the most complexity and create the greatest variance in tax compliance—who is responsible for collecting taxes, for example.

Wayfair

The 2018 South Dakota v. Wayfair, Inc., ruling introduced the concept of economic nexus: If your business sells a certain dollar value, number of items, or completes a certain number of transactions within a tax jurisdiction, the business is considered to have nexus in that jurisdiction. This means taxes will be collected on transactions made in that location.

How Wayfair Affects International Business

There are 32 countries around the world following this rule as of July 1, 2021. When your business expands to global markets, the countries you sell goods in will look to you to collect taxes and duties on those transactions. Countries in the European Union as well as the United Kingdom have a zero-dollar threshold; if you sell $1 in these locations, you have nexus in that jurisdiction and are required to pay taxes there, subject to some transaction value thresholds.

Marketplaces and VAT

VAT is similar to US sales tax and is applied to many goods shipped to the European Union and other non-US jurisdictions. Goods shipped to relevant countries are subject to that country’s import VAT, which can range from zero to 27%.

VAT if Selling Through a Marketplace

If your business is selling though a marketplace, such as Amazon, the marketplace will often collect duties and taxes on your behalf. This rule can apply in both the United States and overseas. It’s critical to understand when a marketplace will or won’t collect tax on customer sales because this will impact the prices you need to set as the seller. When setting the prices on your marketplace store, you’ll need to include any VAT in the cost of your products. Consumers outside the United States and Canada are used to seeing tax inclusive pricing on nearly all sales channels, such as in-store, marketplace, or DTC web sales. When selling direct through your own online store, there are logistical costs on your end to consider, such as shipping, 3PL fees, and import duties. These cost variances can lead to inconsistent pricing across different sales channels.

IT Systems

Compiling, extracting, and reporting on key transactional data is essential to meet global tax compliance, regulatory reporting, and export control requirements, no matter which system your business uses.

Key Transactional Data to Record for Your E-Commerce Business

- Product sold

- Location the product was shipped from

- Location the product was shipped to

- Who the product was sold to

- How much the product was sold for

- Importer of record

- Duties, taxes, and fees

ERP Systems and International Sales

Effectively scaling your business to include international sales requires multiple systems that gather and analyze customer data. Core enterprise resource planning (ERP) systems may need to have foreign taxes, multiple currencies, and data extraction capabilities and sales, VAT, live tax calculation, and customs duty solutions. Common webstore systems include Shopify, Amazon, Zuora, Square, and BigCommerce. These front-end systems may be supported by an underlying financial system such as NetSuite. All systems need to be capable of capturing and reporting accurate data on e-commerce sales. When considering your data tracking system, ask yourself these questions:

- How much do you pay in indirect tax and duty on purchases or shipments?

- How much do you collect on sales?

- Is pricing consistent across multiple sales channels, jurisdictions, and currencies?

- Does your organization have access to transactional level data for all sales?

- What are the business requirements related to your pricing, supply chain, and technological needs?

- Do you have gaps in data or process? Once you have reviewed gaps prior to sales taking place, are they impacting reporting or compliance?

We’re Here to Help

To assess your business’s needs and develop a supply chain strategy, contact your Moss Adams professional.